In a significant development that could bring relief to millions of policyholders, India’s Goods and Services Tax (GST) council has reached a consensus on the necessity of lowering the tax rate on health and life insurance premiums. This decision comes in response to mounting public criticism over the existing 18% tax levied on these essential services. While no final decision has been made, the council has set the wheels in motion to reconsider the current tax rate.

Table of Contents

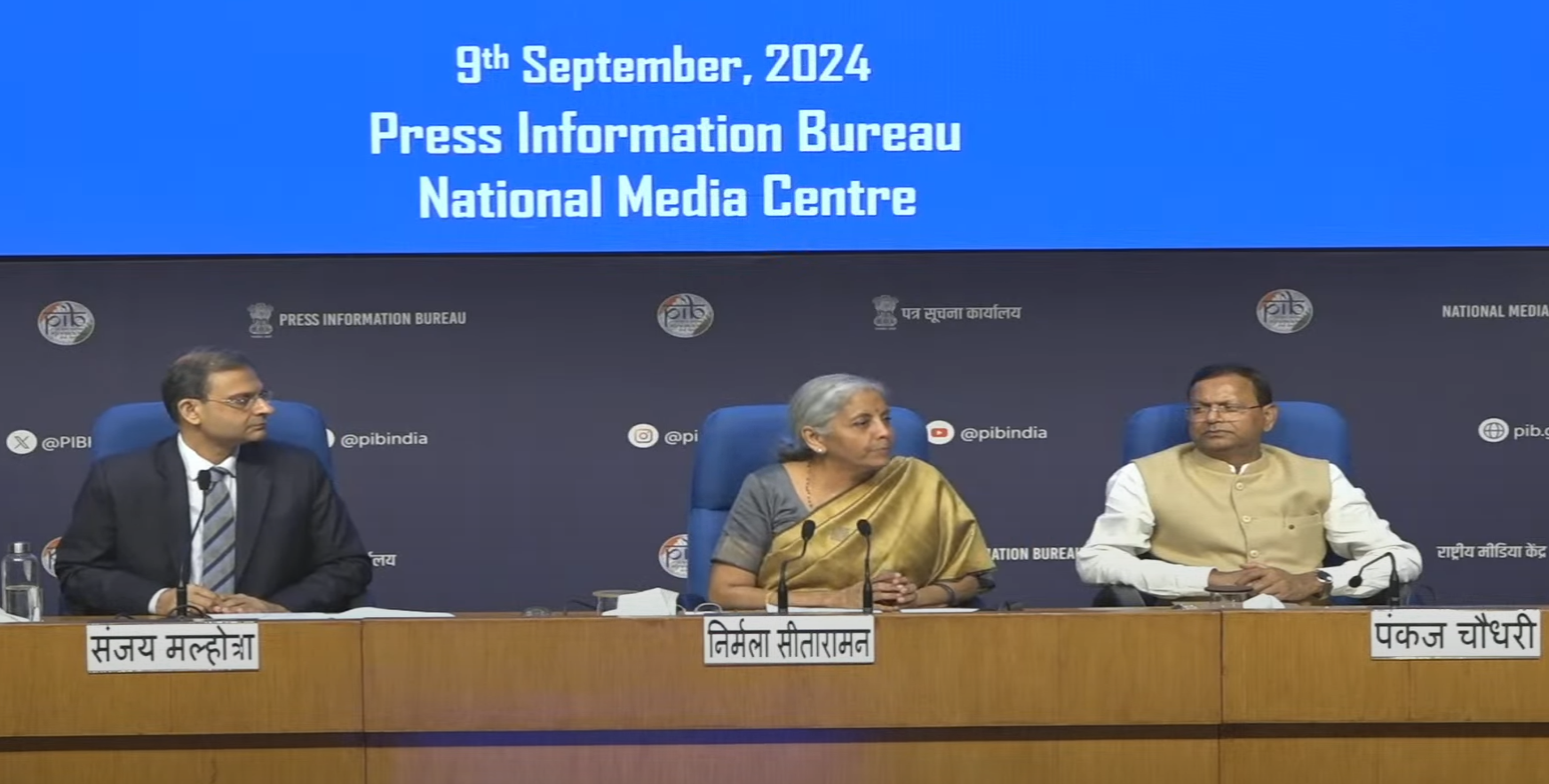

At a press conference on Monday, Finance Minister Nirmala Sitharaman announced that a panel of ministers would submit a detailed report by the end of next month. The GST council will then revisit the issue at its November meeting, where a final decision is expected.

Why Is This Important?

Health and life insurance have become more crucial than ever, especially in the wake of the COVID-19 pandemic. These policies provide financial security to families and individuals during unforeseen circumstances, such as medical emergencies or the death of a loved one. However, the 18% GST on insurance premiums has been seen as an added financial burden on taxpayers. The tax on insurance policies has long been a point of contention, with critics arguing that taxing life’s uncertainties is both insensitive and counterproductive.

A considerable section of the public has voiced concerns about this tax on social media. Some feel that the government should focus on making health and life insurance more affordable, rather than taxing essential services. A leaked letter from a government minister opposing the tax further fueled this sentiment.

Reducing the GST on insurance premiums would not only provide financial relief to policyholders but also make insurance more accessible to a larger segment of the population, potentially increasing the penetration of insurance in the country. Currently, India lags behind other countries in terms of insurance coverage, and lowering the tax rate could encourage more people to invest in policies for their well-being and future.

How Did We Get Here?

The GST regime, introduced in 2017, overhauled India’s indirect tax system by unifying multiple taxes under one umbrella. The council, chaired by the finance minister and composed of state ministers, is responsible for deciding on changes to GST rates. Since its inception, the council has made several adjustments, responding to economic needs and public sentiment.

In the case of health and life insurance, the criticism over the 18% GST has gained momentum over the past few years. Many believe that, given the increasing costs of healthcare and the importance of securing one’s life, the government should treat insurance premiums differently from other taxable services. The call for a reduction gained even more traction during the pandemic, when the role of health insurance became even more vital in protecting individuals and families from financial ruin.

What Could Happen Next?

While the decision to lower the GST on health and life insurance premiums is not yet finalized, the council’s consensus on the need for change is a significant step forward. According to Sitharaman, the council is awaiting the report from the panel of ministers, which will assess the financial and economic implications of reducing the tax rate. If the report is favorable, a reduction in GST could be on the horizon.

For now, policyholders will need to wait until November when the council is expected to discuss the issue further. If the GST on insurance premiums is lowered, it could signal a broader shift in how the government views essential financial services like insurance.

Possible Impact of the Tax Cut

If the GST on health and life insurance premiums is reduced, it could have a far-reaching impact:

- Financial Relief for Consumers: A lower GST rate would reduce the overall cost of insurance policies, providing direct financial relief to millions of existing policyholders. This could also encourage more people to invest in insurance, especially in rural and lower-income areas where affordability is a major concern.

- Increased Insurance Penetration: India has one of the lowest insurance penetration rates in the world, with many people still uninsured or underinsured. A reduction in the GST rate could help bridge this gap by making insurance policies more affordable and accessible.

- Boost to the Insurance Industry: Lowering the GST on insurance premiums could lead to an increase in the number of policyholders, giving a significant boost to the insurance industry. This could result in more revenue for insurance companies and increased employment opportunities within the sector.

- Potential Long-Term Savings: For individuals, the reduced tax burden could lead to long-term savings on their insurance policies. This could, in turn, allow families to allocate more resources to other essential needs like education, housing, or retirement planning.

Other Changes on the Horizon

While the reduction in GST on insurance premiums is the headline, the council is also considering extending additional taxes on certain goods beyond March 2026. These goods include high-end cars, tobacco products, aerated drinks, and coal. These additional taxes, which were initially set to expire in 2026, are now expected to continue. According to a source familiar with the matter, this extension is part of the government’s broader strategy to maintain fiscal balance and generate revenue from high-consumption products.

Conclusion

As the Indian GST council moves towards a potential reduction in the tax on health and life insurance premiums, the public and the insurance industry alike are waiting for a favorable decision. This move could lead to significant financial relief for consumers and help boost insurance coverage across the country. While a final decision will be made later this year, the council’s current direction is a promising sign for millions of policyholders. In the meantime, the public can continue to engage in discussions and keep an eye on the developments leading up to the November council meeting.

In a significant development that could bring relief to millions of policyholders, India’s Goods and Services Tax (GST) council has reached a consensus on the necessity of lowering the tax rate on health and life insurance premiums. This decision comes in response to mounting public criticism over the existing 18% tax levied on these essential services. While no final decision has been made, the council has set the wheels in motion to reconsider the current tax rate.

At a press conference on Monday, Finance Minister Nirmala Sitharaman announced that a panel of ministers would submit a detailed report by the end of next month. The GST council will then revisit the issue at its November meeting, where a final decision is expected.

Why Is This Important?

Health and life insurance have become more crucial than ever, especially in the wake of the COVID-19 pandemic. These policies provide financial security to families and individuals during unforeseen circumstances, such as medical emergencies or the death of a loved one. However, the 18% GST on insurance premiums has been seen as an added financial burden on taxpayers. The tax on insurance policies has long been a point of contention, with critics arguing that taxing life’s uncertainties is both insensitive and counterproductive.

A considerable section of the public has voiced concerns about this tax on social media. Some feel that the government should focus on making health and life insurance more affordable, rather than taxing essential services. A leaked letter from a government minister opposing the tax further fueled this sentiment.

Reducing the GST on insurance premiums would not only provide financial relief to policyholders but also make insurance more accessible to a larger segment of the population, potentially increasing the penetration of insurance in the country. Currently, India lags behind other countries in terms of insurance coverage, and lowering the tax rate could encourage more people to invest in policies for their well-being and future.

How Did We Get Here?

The GST regime, introduced in 2017, overhauled India’s indirect tax system by unifying multiple taxes under one umbrella. The council, chaired by the finance minister and composed of state ministers, is responsible for deciding on changes to GST rates. Since its inception, the council has made several adjustments, responding to economic needs and public sentiment.

In the case of health and life insurance, the criticism over the 18% GST has gained momentum over the past few years. Many believe that, given the increasing costs of healthcare and the importance of securing one’s life, the government should treat insurance premiums differently from other taxable services. The call for a reduction gained even more traction during the pandemic, when the role of health insurance became even more vital in protecting individuals and families from financial ruin.

What Could Happen Next?

While the decision to lower the GST on health and life insurance premiums is not yet finalized, the council’s consensus on the need for change is a significant step forward. According to Sitharaman, the council is awaiting the report from the panel of ministers, which will assess the financial and economic implications of reducing the tax rate. If the report is favorable, a reduction in GST could be on the horizon.

For now, policyholders will need to wait until November when the council is expected to discuss the issue further. If the GST on insurance premiums is lowered, it could signal a broader shift in how the government views essential financial services like insurance.

Possible Impact of the Tax Cut

If the GST on health and life insurance premiums is reduced, it could have a far-reaching impact:

- Financial Relief for Consumers: A lower GST rate would reduce the overall cost of insurance policies, providing direct financial relief to millions of existing policyholders. This could also encourage more people to invest in insurance, especially in rural and lower-income areas where affordability is a major concern.

- Increased Insurance Penetration: India has one of the lowest insurance penetration rates in the world, with many people still uninsured or underinsured. A reduction in the GST rate could help bridge this gap by making insurance policies more affordable and accessible.

- Boost to the Insurance Industry: Lowering the GST on insurance premiums could lead to an increase in the number of policyholders, giving a significant boost to the insurance industry. This could result in more revenue for insurance companies and increased employment opportunities within the sector.

- Potential Long-Term Savings: For individuals, the reduced tax burden could lead to long-term savings on their insurance policies. This could, in turn, allow families to allocate more resources to other essential needs like education, housing, or retirement planning.

Other Changes on the Horizon

While the reduction in GST on insurance premiums is the headline, the council is also considering extending additional taxes on certain goods beyond March 2026. These goods include high-end cars, tobacco products, aerated drinks, and coal. These additional taxes, which were initially set to expire in 2026, are now expected to continue. According to a source familiar with the matter, this extension is part of the government’s broader strategy to maintain fiscal balance and generate revenue from high-consumption products.

As the Indian GST council moves towards a potential reduction in the tax on health and life insurance premiums, the public and the insurance industry alike are waiting for a favorable decision. This move could lead to significant financial relief for consumers and help boost insurance coverage across the country. While a final decision will be made later this year, the council’s current direction is a promising sign for millions of policyholders. In the meantime, the public can continue to engage in discussions and keep an eye on the developments leading up to the November council meeting.

Also Read https://qltimes.com/flying-into-the-futurejoby-aviation-applies-for-uaes/